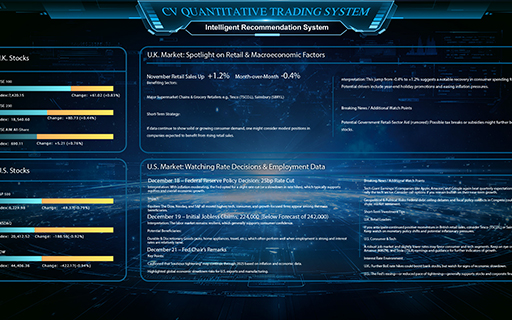

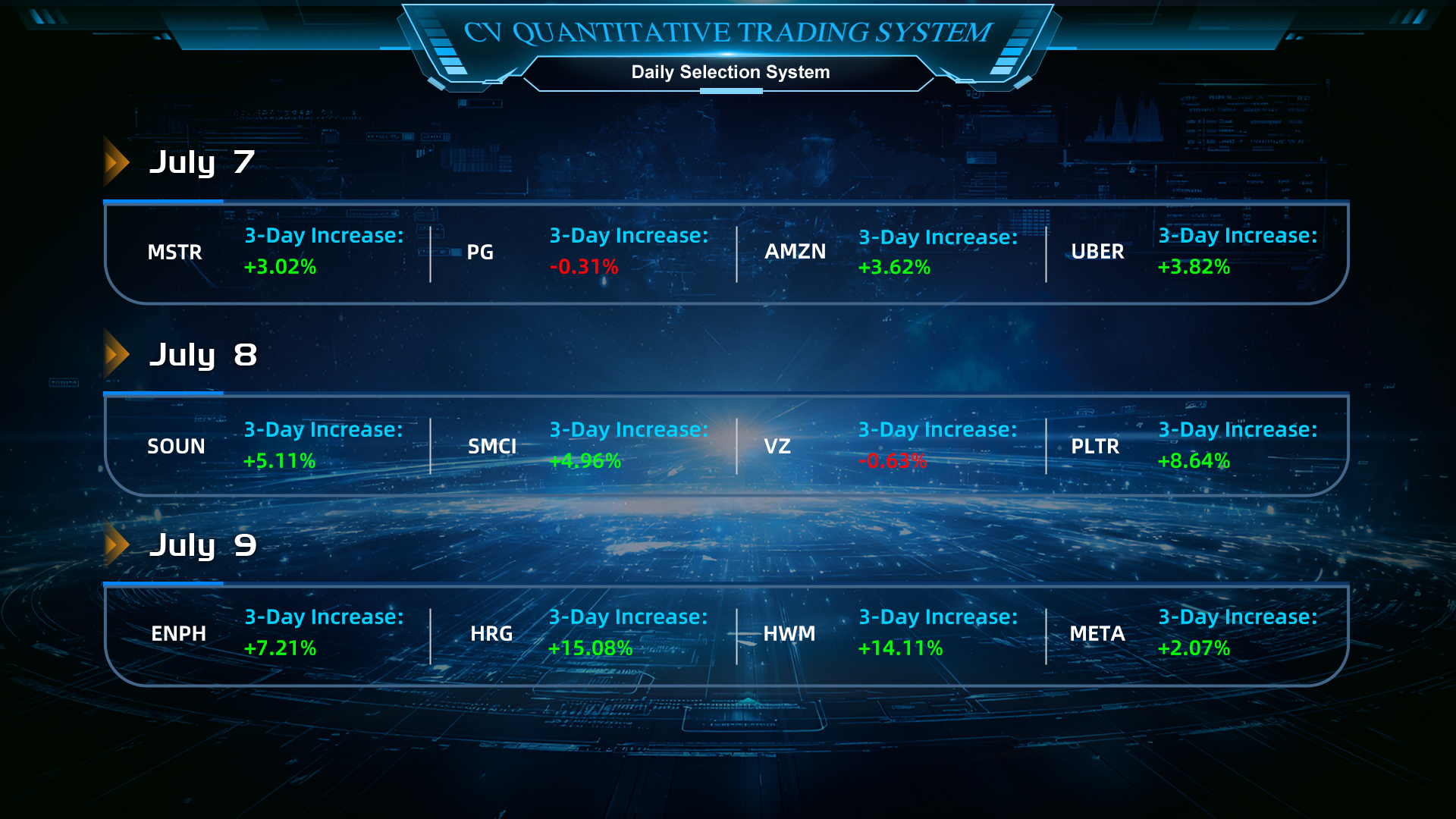

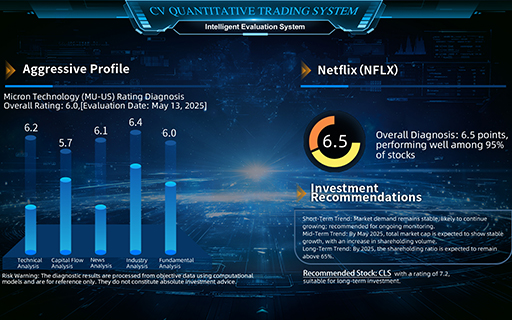

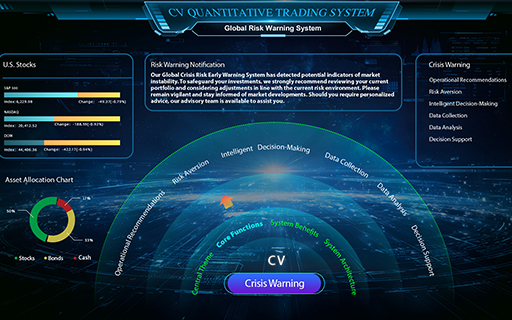

CV Quantitative Trading System

the CV quantitative system offers significant advantages over traditional financial models, with a focus on transparency, data-driven decision-making, and personalized, 24/7 support. By prioritizing client interests and leveraging cutting-edge technology, CV ensures that your wealth management is efficient, consistent, and future-ready.